Tax Increases: What You Need To Know

September 23, 2021 - 4 minutes read

Posted by Claire Parker

The recent announcements about tax rises were no surprise after more than a year of expensive Covid interventions such as furlough. However, with the Government targeting employee and employer National Insurance, dividends and corporation tax, some pockets are being hit from all angles, and for the long-term. Here, we summarise the increases and explain how you may be affected.

The Tax Rises in Summary

State Pensions

For a little while, anyone drawing the state pension could be forgiven for showing a hint of excitement with a predicted 8% rise under the Government’s ‘triple lock’ system.

Unsurprisingly, the excitement wasn’t shared by the Government which has now announced a one-year suspension of the ‘triple lock’, describing the figure as a ‘statistical anomaly’ skewed by the pandemic recovery. Instead of pensions increasing with post-pandemic inflation, they will now rise by 2.5% or in line with the consumer inflation rate, returning to the triple lock next year.

What can you do?

Even with auto-enrolment, it’s thought that the state pension will meet only 30% of basic living costs for the average person. This prediction, along with the deviation from the triple lock, further underlines the value of having a personal pension and multiple income streams, to maintain the lifestyle you envisage.

All of our clients benefit from having a lifetime cashflow forecast which shows how your income/expenditure looks over the long-term, enabling you to make good decisions about your lifestyle and wealth.

National Insurance

National Insurance is increasing until April 2023 to help boost the Treasury coffers to fund social care. The increase of 1.25% affects both employees and employers. If your working days are over, that’s good news as this tax won’t affect you. However, if you are not yet retired, and particularly if you own a company and are an employer, then the outlook is a little more bleak, especially in light of the Corporation Tax increase from 19% to 25% which is due to take effect in 2023.

The National Insurance increase is a temporary measure. In April 2023, National Insurance will return to its current rate and an additional tax will be collected, the Health and Social Care Levy. An important distinction is that the Levy will be paid by all working people, including people of state pension age who continue to work.

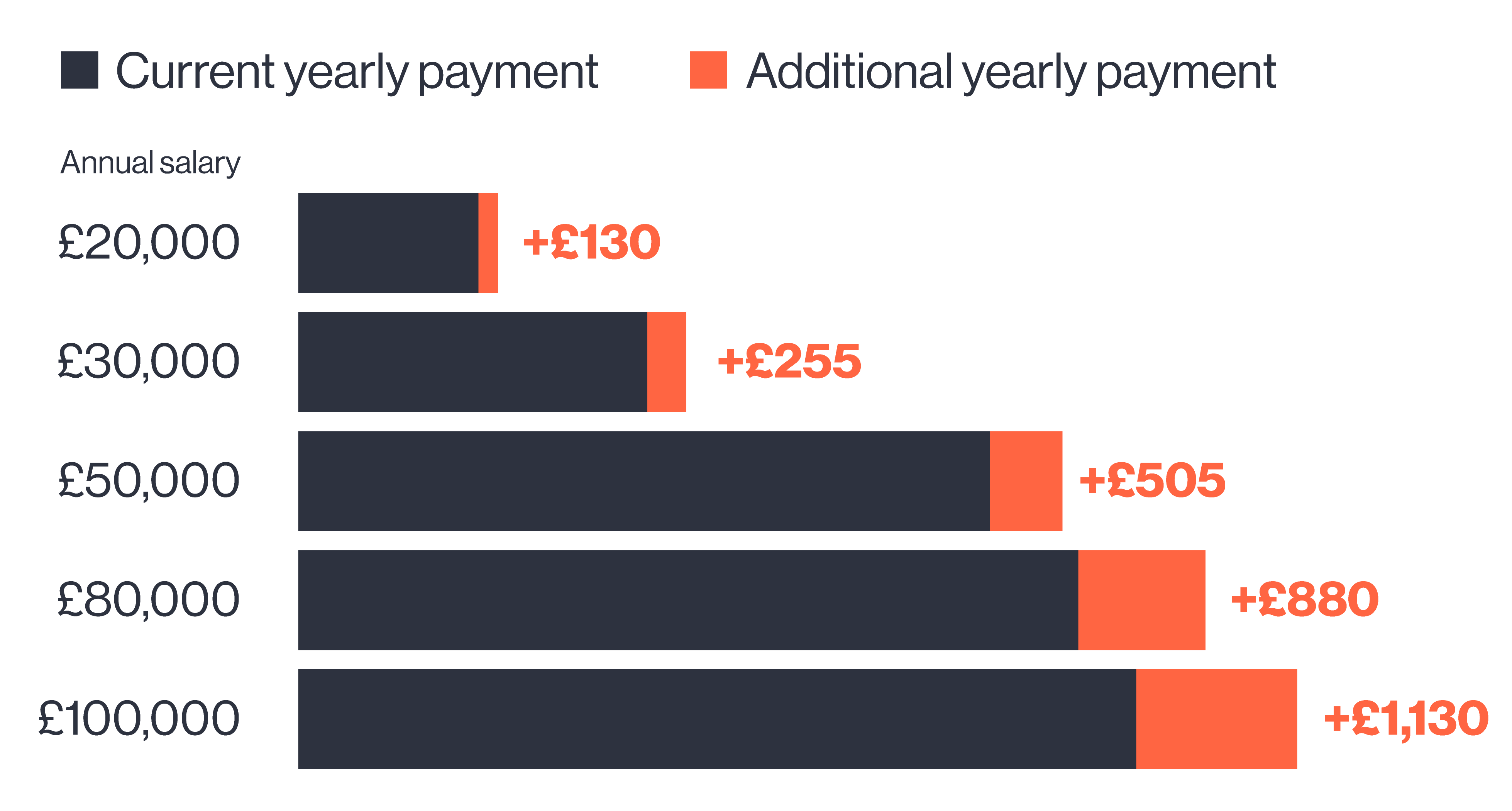

The chart below shows the impact of the National Insurance increase on employees.

Initially, the additional tax raised by the National Insurance increase will go towards easing pressure on the NHS with a portion being moved into social care over the next three years.

On the subject of the cost of social care, the Government has stated its aim is to ensure that people in England pay no more than £86,000 in care costs from October 2023, excluding accommodation and food. If you have between £20,000 and £100,000 in assets (such as your home or income from investments) you will be entitled to subsidised care. Assets of £100,000+ leave you fully liable for your care costs until the value of your assets has reduced to £23,250.

What can you do?

Whatever your current age, it’s extremely important to arrange your estate and affairs with the cost of ongoing health and social care in mind. If you are a client of Xentum, you will receive tailored advice to protect you and your loved ones and to properly arrange the assets you have worked hard for.

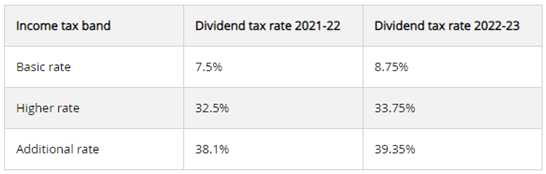

Dividend Tax

Staying with the topic of employment and work-related tax, there is also a change to dividend tax, with an increase of 1.25% being introduced. This means your income from company shares, with the exception of stocks and shares ISAs, will be affected.

The new tax comes into effect in April next year and the Government has pledged to use the extra money to help clear NHS waiting list backlogs as well as put a portion towards the cost of providing social care.

What can you do?

It is advisable to review your share portfolio to ensure you are making the most of your £2,000 annual dividend allowance and your £12,570 income tax allowance.

You should also maximise your ISA, pension and CGT allowance. Wealth within ISAs and pensions grows tax-free; there is no tax charged when you withdraw income from an ISA and whilst pension income is taxable, you get 25% tax-free and it isn’t subject to National Insurance.

If you sell shares, you could pay tax on profits which becomes subject to Capital Gains Tax, though remember you have an annual tax-free allowance, currently £12,300.

Is It All Bad News?

Looking on the bright side, no one can deny that a well-funded NHS is something that benefits us all. And millions of people’s livelihoods were saved by the furlough scheme. Plus, the cost of long-term social care, which the National Insurance increase is targeting, is a problem that’s needed to be addressed for a very long time.

That said, the fact that so many tax rises have been announced in a matter of just a few months further underpins the need for a sound financial plan. Clear financial goals and clarity around what’s important to you – and what your money is for – means you can evaluate the changes and choose an appropriate response.

If you’re not yet a Xentum client and would like to find out more about financial planning, please get in touch to arrange an exploratory discussion.

Find out more about WealthPlan™, our unique approach to financial planning, and our unique fee structure.